Call For a Quote!

Facing CRA Issues?

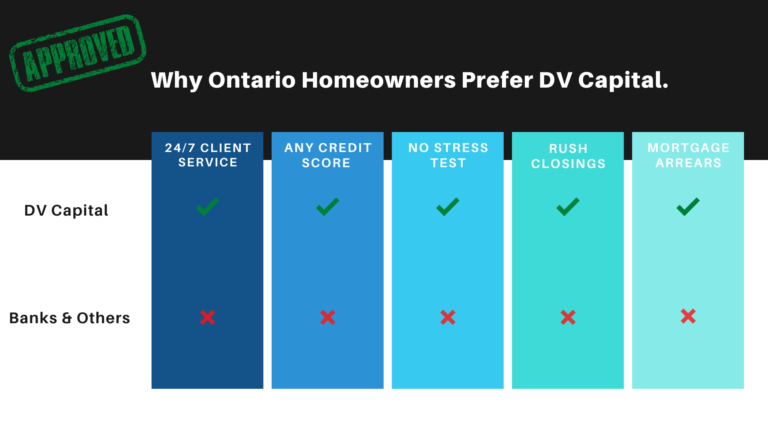

Turned Down Elsewhere?

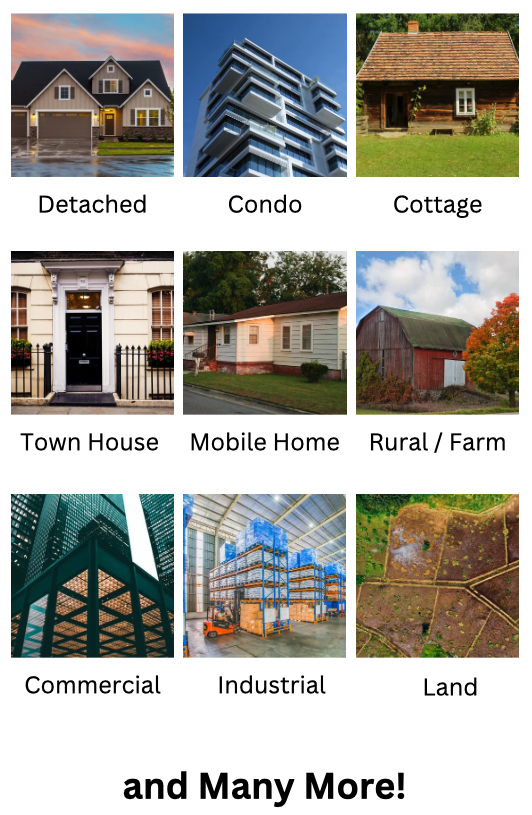

We Help Homeowners Ontario-Wide!

-

Direct Private Mortgage Lender.

-

Access Your Hard Earned Home Equity.

-

Behind on Income Tax Filing?

-

Personal Income Tax Balance Owing?

-

Corporate Income Tax Balance Owing?

-

Behind On GST/HST or Source Deductions?

-

Tax Lien Registered on Your Home?

-

Bank Account & Assets Seized?

-

Upfront & Transparent Quotes.

-

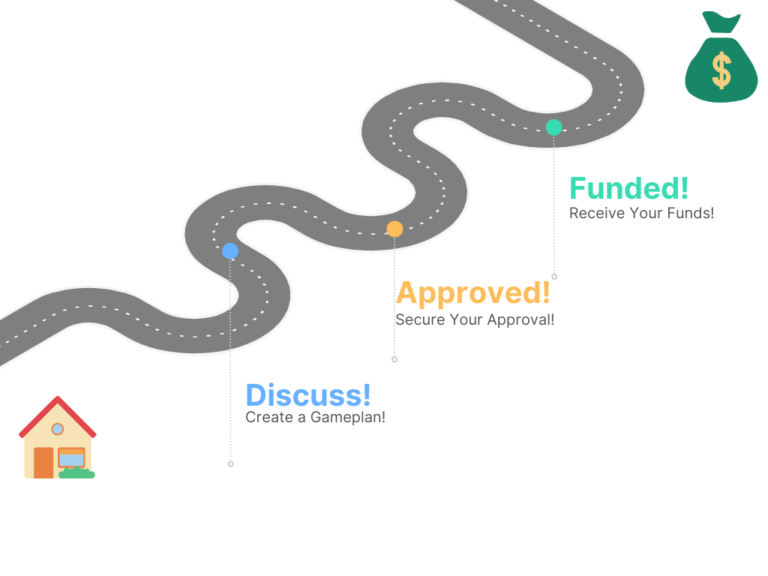

Complimentary Mortgage Assessments.

★★★★★ 5/5