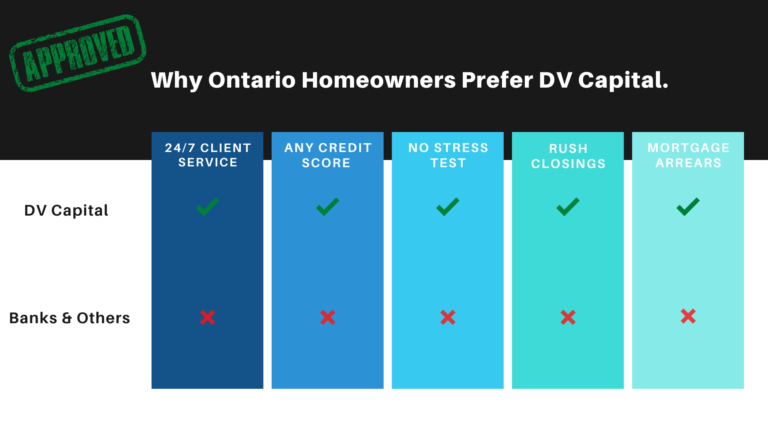

DV Capital Corporation is licensed and regulated as a Mortgage Brokerage with the Financial Services Regulatory Authority of Ontario and is a corporate member of Mortgage Professionals Canada, Canadian Mortgage Brokers Association of Ontario, British Columbia and Atlantic Canada. DV Capital excels in the alternative mortgage market, a marketplace often under-serviced by traditional mortgage lenders and other mortgage providers that lack the expertise, knowledge and lender connections required to help clients cross the finish line.